What Are Smart Contracts and How Do They Work?

DAte

Nov 10, 2025

Category

Smart Contract

Reading Time

9 Min

You've probably heard the term "smart contract" thrown around in blockchain conversations, usually followed by breathless claims about revolutionizing everything from banking to real estate. Strip away the hype and here's what you're left with: a piece of code that executes automatically when specific conditions are met. That's it. No lawyers needed, no oversight required, no trust necessary.

Sounds simple, right? It is. But simple doesn't mean trivial. Smart contracts are fundamentally changing how we think about agreements, transactions, and automation. Let's break down what they actually are, how they work, and where they make sense in the real world.

What Exactly Is a Smart Contract?

Think of a vending machine. You insert money, press a button, and the machine delivers your snack. No cashier needed, no negotiation, no possibility of the machine "deciding" not to give you what you paid for. The mechanism is simple: money in, snack out. Conditions met, action executed.

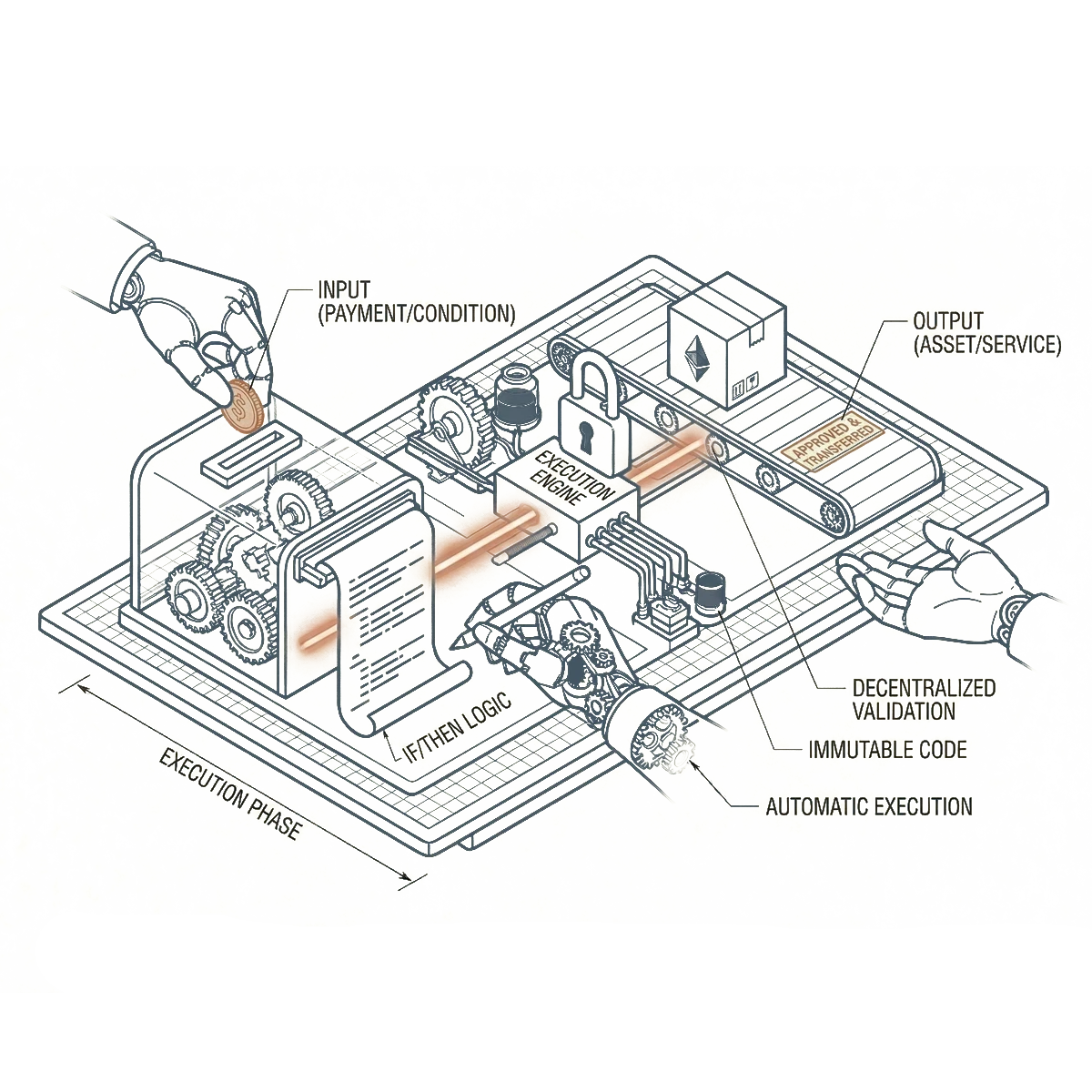

A smart contract is essentially a vending machine for anything digital. It's a program stored on a blockchain that runs automatically when predetermined conditions are satisfied. When X happens, do Y. No interpretation, no discretion, no middlemen taking a cut or slowing things down.

The "contract" part is a bit of a misnomer—it's really just code. And "smart" is generous—the code does exactly what it's programmed to do, nothing more, nothing less. But here's the magic: once deployed on a blockchain, that code is immutable, transparent, and guaranteed to execute exactly as written. No one can change it, no one can stop it, everyone can verify it.

For businesses, this means you can automate complex multi-party agreements without needing to trust the other parties or rely on intermediaries. The code is the contract. The blockchain ensures execution.

How Do Smart Contracts Actually Work?

Let's walk through a real example. Say you're buying a house. Traditionally, here's what happens: you and the seller agree on price, lawyers draft contracts, you put money in escrow, title company verifies ownership, bank approves financing, everyone signs papers, escrow releases funds, title transfers. Weeks of back-and-forth, thousands in fees, countless points of potential failure.

With a smart contract, the entire process could look like this:

Step 1: The contract is written in code: "IF buyer deposits $500,000 AND seller proves ownership AND inspection clears AND financing approved, THEN transfer title to buyer AND release funds to seller."

Step 2: Contract deploys to blockchain. Now it's permanent, visible to all parties, and will execute exactly as coded.

Step 3: Buyer deposits funds into the smart contract (not to escrow, to the contract itself). Funds are locked until conditions are met.

Step 4: Seller submits proof of ownership (digitally verified title). Inspector submits report. Bank confirms financing.

Step 5: All conditions satisfied? Contract executes automatically. Title transfers to buyer, funds release to seller. Transaction complete in minutes, not weeks.

No lawyers managing the process. No escrow company holding funds. No title company coordinating. The smart contract handles everything—because it's programmed to verify each condition and execute the transaction when they're all met.

That's the power: automation of trust. You don't need to trust the other party or trust intermediaries. You trust the code, and the blockchain guarantees the code runs as written.

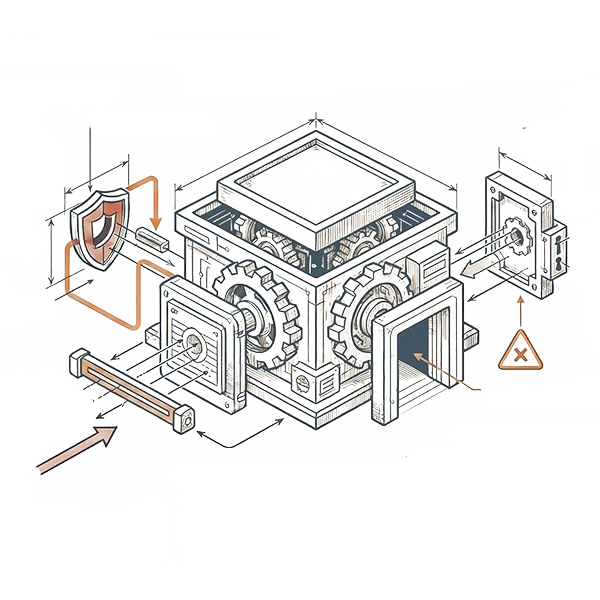

The Technology Behind Smart Contracts

Smart contracts live on blockchains—distributed ledgers maintained by networks of computers rather than single entities. When you deploy a smart contract, you're not putting it on someone's server; you're putting it on thousands of servers simultaneously.

This matters because:

Immutability: Once deployed, the contract can't be changed. Not by you, not by anyone. The code is the code. This sounds limiting (and sometimes is), but it's also the entire point—guaranteed execution means guaranteed immutability.

Transparency: Anyone can inspect the contract's code and verify what it does. No hidden clauses, no fine print, no surprises. The logic is completely visible.

Decentralization: No single point of failure. No server to go down, no company to go bankrupt, no government to shut down. The contract exists as long as the blockchain exists.

Deterministic Execution: Given the same inputs, the contract always produces the same outputs. No human judgment, no discretion, no variation.

Different blockchains handle smart contracts differently. Ethereum pioneered the concept and remains the most popular platform, with its Solidity programming language becoming the industry standard. Other blockchains like Binance Smart Chain, Solana, and Cardano offer their own implementations, each with different tradeoffs in speed, cost, and flexibility.

For companies looking to implement smart contracts, choosing the right blockchain is critical. Ethereum offers the most mature ecosystem and developer tools but can be expensive. Newer chains offer speed and low costs but less battle-testing. Base58 helps businesses navigate these tradeoffs, matching technical requirements to the right blockchain infrastructure.

Where Smart Contracts Make Sense

Not everything needs a smart contract. Sometimes traditional systems work fine. But certain use cases benefit massively from automation, transparency, and elimination of middlemen:

Financial Services and DeFi

Lending, borrowing, trading—all can be automated through smart contracts. Decentralized finance (DeFi) platforms use smart contracts to let users lend crypto and earn interest, borrow against collateral, or trade assets without centralized exchanges. No loan officers, no approval processes, no banking hours. Put up collateral, get a loan. Instantly.

The numbers are staggering: billions of dollars locked in DeFi protocols, all managed by smart contracts. For traditional financial institutions, this represents both competition and opportunity. Smart contracts can dramatically reduce operational costs while increasing transaction speed and transparency.

Base58 designs and deploys DeFi protocols for companies entering this space—from basic staking mechanisms to complex lending platforms to derivatives. The key is balancing innovation with security and regulatory compliance.

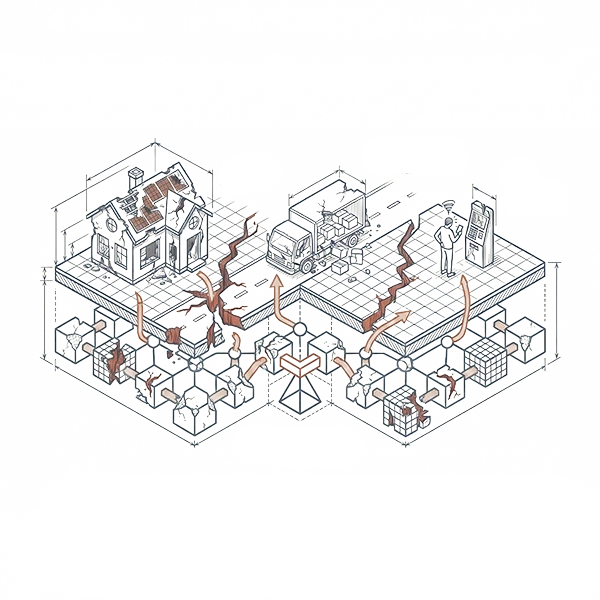

Supply Chain Management

Track products from manufacture to delivery with smart contracts automatically recording each step. When goods arrive at a checkpoint, the contract updates. When delivery is confirmed, payment releases. No disputes about who did what when—the blockchain has a permanent, tamper-proof record.

For industries where provenance matters—pharmaceuticals, luxury goods, food safety—this is transformative. Fake products can't fake blockchain records. Temperature-sensitive shipments can trigger automatic refunds if conditions aren't met. Payments can release in stages as milestones are hit.

Insurance and Claims Processing

Insurance is fundamentally about: if X happens, pay Y. That's literally what smart contracts do best. Flight delayed more than 3 hours? Smart contract automatically pays out. Crop yield below threshold due to weather? Parametric insurance contract executes. No claims forms, no adjusters, no waiting weeks for approval.

The efficiencies are massive. Fraud decreases because conditions are objectively verifiable. Processing costs plummet because automation replaces manual review. Payouts happen instantly because the contract doesn't need management approval.

Digital Rights and Royalties

Creators get paid automatically every time their work is used. A song plays on a streaming platform? Smart contract distributes royalties to all rightsholders according to predefined splits. An image licenses for commercial use? Payment flows through instantly, with a percentage going to the original creator.

For creative industries plagued by delayed payments, opaque accounting, and rights disputes, smart contracts offer something revolutionary: immediate, transparent, automatic compensation. No chasing publishers for royalty statements. No wondering if you got paid correctly. The contract handles everything.

Real Estate and Tokenization

Beyond simple property transfers, smart contracts enable fractional ownership. A commercial building tokenized into 1000 shares, with rental income automatically distributed to token holders monthly via smart contract. No property management company taking their cut. No quarterly reports. Just automatic, proportional payments.

For investors, this means access to real estate markets previously restricted to the wealthy. For property owners, it means liquidity—selling 10% of a building is easier than selling the whole thing. Smart contracts make all of this possible without traditional financial intermediaries.

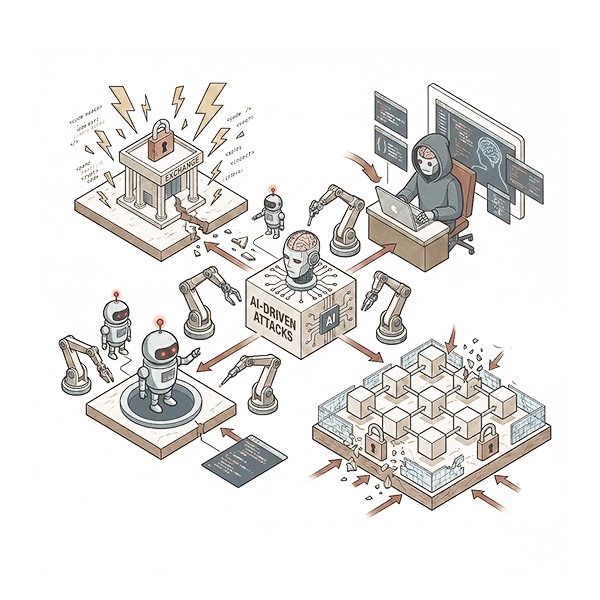

The Limitations and Risks

Let's be honest: smart contracts aren't perfect. They come with real challenges and limitations.

Code Is Law: If there's a bug in the contract, there's no "undo" button. The infamous DAO hack in 2016 saw $60 million drained from a smart contract due to a code vulnerability. The contract worked exactly as written—the problem was it was written with a flaw.

This makes audit and testing absolutely critical. Professional smart contract development involves extensive code review, formal verification, and security audits. Base58 and similar firms spend significant resources on security because a single bug can be catastrophic.

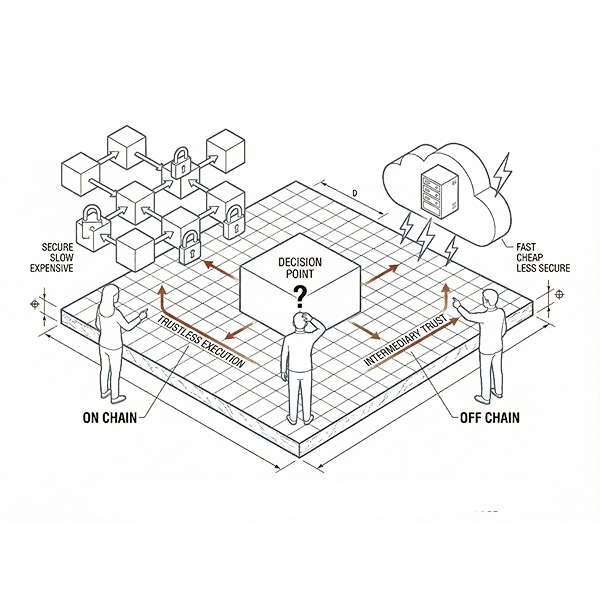

Oracle Problem: Smart contracts can't access data outside the blockchain on their own. They need "oracles"—external data feeds that provide real-world information. Did the flight actually delay? What's the current market price? Is the weather actually bad enough to trigger the insurance payout?

Oracles introduce a trust assumption: you're trusting the data feed. This somewhat undermines the trustless nature of smart contracts, which is why oracle design is a major area of blockchain development.

Immutability Is a Double-Edged Sword: Can't change the contract after deployment means you better get it right the first time. It also means you can't adapt to changing regulations, business needs, or discovered issues without deploying an entirely new contract and migrating users.

Some smart contract platforms now include upgrade mechanisms, but these introduce their own complexities and trust assumptions.

Legal Recognition: In most jurisdictions, smart contracts aren't legally recognized as contracts in the traditional sense. If something goes wrong, what's your legal recourse? Can you take a smart contract to court? These questions are still being worked out.

Professional implementations require parallel legal frameworks. The smart contract handles execution, but traditional legal agreements provide backup and define terms in ways courts will recognize.

Building Smart Contracts: Not for Amateurs

Writing smart contracts requires specialized skills. This isn't WordPress plugin development—you're writing code that will handle real money, be publicly visible, and be impossible to change once deployed. The stakes are high.

Smart contract developers typically use:

Solidity for Ethereum and EVM-compatible chains—the most common language with the most tools and libraries. Rust for Solana and some other modern chains—more complex but offers performance benefits. Plutus for Cardano—functional programming approach with different security properties.

Development involves writing the contract code, extensive testing in local environments, deployment to test networks, security audits by specialized firms, and finally deployment to mainnet. Even then, many contracts include safeguards like time locks, multi-signature controls, and emergency pause functions.

For businesses, trying to build smart contracts in-house without blockchain expertise is asking for trouble. The complexity isn't just technical—it's understanding how blockchain economics work, how users will interact with contracts, how to design for gas efficiency, how to handle edge cases that could be exploited.

This is where companies like Base58 (base58.io) add value. They've built dozens of smart contract systems across different industries and blockchains. They know the gotchas, they've seen the exploits, they understand both the technical and business considerations. When you're deploying contracts that will handle significant value, experience matters.

Smart Contracts in Practice

The difference between smart contracts as concept and smart contracts as implementation is vast. Theory is elegant. Practice is messy.

Real implementations require:

Integration with existing business systems

User interfaces that hide blockchain complexity

Graceful handling of blockchain quirks like variable transaction times

Compliance frameworks for regulated industries

Security measures beyond just the contract code

Economic models that make sense for all participants

Support and monitoring infrastructure

A smart contract alone is just code. A smart contract system is the contract plus all the infrastructure needed to make it usable and valuable.

Base58 specializes in these complete implementations—not just deploying a contract but building the entire ecosystem around it. From user onboarding to transaction monitoring to compliance reporting to ongoing security, they handle the full stack required to make smart contracts work in production environments.

The Future Is Automated

Smart contracts won't replace all traditional agreements. Many situations benefit from human judgment, flexibility, and nuance. But where you need automation, transparency, and elimination of intermediaries—smart contracts are increasingly the obvious choice.

We're still early. The technology is maturing, the tools are improving, and the use cases are expanding beyond DeFi into mainstream business operations. Companies that understand how to leverage smart contracts effectively will have significant advantages in efficiency, transparency, and operational costs.

The question isn't whether smart contracts will be part of your industry. They already are, or soon will be. The question is whether you'll be leading the adoption or catching up later.

Conclusion

Smart contracts represent a fundamental shift in how we automate trust and execution in digital transactions. They're not magic, and they're not perfect, but they offer capabilities that traditional systems simply cannot match: guaranteed execution, complete transparency, elimination of intermediaries, and automation of complex multi-party agreements. For businesses considering blockchain solutions, smart contracts are often the killer application—the feature that delivers the most immediate and measurable value. Whether it's automating payments, managing supply chains, processing insurance claims, or distributing royalties, smart contracts can eliminate inefficiencies and reduce costs while increasing transparency and trust.

Leo Park

Blockchain Expert